Credit Card fraud Management System

ABSTRACT: –

With the age of digitization, there is an increased amount of usage of online trans- actions via credit cards and net banking options. With e-commerce services offered by most of the websites, credit cards have become a popular mode of payment. With the increase in credit card transactions, there has been a hike in the number of fraud- ulent transactions as well. Such an increase hampers the trust of the people on online transactions as well leads to billions of losses for banks all over the world. As per the reports of 2018, credit card frauds increased by 18.4 percent and led to a loss of 24.26 billion dollars. To curb these tremendous losses, the researchers began using differ- ent techniques and methods to prevent and detect unusual transactions. Frauds are known to be dynamic and have no patterns, hence they are not easy to identify. Fraud- sters use recent technological advancements to their advantage. They somehow bypass security checks, leading to the loss of millions of dollars. Analyzing and detecting un- usual activities using data mining, machine learning and deep learning techniques is one way of tracing fraudulent transactions. Many artificial intelligence techniques have been proposed to deal with the anomaly detection problem; some results appear to be considerably assuring, but there is no explicit superior solution.

This project aims to elucidate the modeling of credit card transactions with the statistical data of the transactions that turned out to be fraud. A range of algorithms such as isolation forest, histogram based outlier de- tection (HBOS), cluster based local outlier factor (CBLOF), principal component anal- ysis (PCA), K-means, deep auto encoder networks and ensemble method are evaluated and compared. This is exhibited by making data sets using machine learning with Credit Card Fraud Detection. The Credit Card Fraud Detection model is then used to determine whether a new transaction is fraudulent or not. Our objective here is to detect 100 percent of the fraudulent transactions while minimizing the incorrect fraud classifications. Credit Card Fraud Detection is a typical sample of classification. In this process, we have focused on analyzing and pre-processing data sets as well as the organization of multiple anomaly detection algorithms.

Keywords: Credit Cards, K-Nearest Neighbour (KNN), Random Forest, Naïve Bayes, Logistic Regression, anomaly detection.

SYSTEM:-

- Data Retrieval: The system should be able to retrieve data from various sources such as transaction logs, user data, and external data.

- Preprocessing: Clean up inconsistent data and remove invalid data before incoming data.

- Feature Engineering: The system should generate relevant features from data such as currency rates, locations, and device information.

- Model selection: The system should select the appropriate machine learning for fraud detection based on performance criteria such as accuracy, precision, recall, and F1 score. Some algorithms to consider are KNN, Random Forest, Naive Bayes and Logistic Regression.

- Model training: The system should train machine learning models on business history data that is considered fraudulent or legitimate.

- Real-time scoring: After the model is trained, the system should score the products in real-time, giving each operation a false score. This fraud score can be used to determine whether a transaction is legitimate or fraudulent.

- Policy Engine: The system can also use the policy engine to define specific business rules and thresholds for certain business types. For example, trading over a certain amount may require additional verification.

- Anomaly detection: The system should use an anomaly detection system to identify anomalies in the data that may indicate fraudulent data.

- Alerts and Notifications: If the transaction is considered fraudulent, the system should generate an alert or alert to the fraud analyst.

- Case Management: The system should provide an information management system where fraud analysts can manage and track incidents such as blocking cards or depositing money, and record their findings.

- Reporting and Analysis: The system should be able to report and analyze to help financial institutions monitor fraud and identify areas for improvement.

- Integration: The system should be integrated with other systems and applications such as customer relationship management (CRM), fraud prevention tools, and payment gateways.

Overall, credit card fraud management is a complex and evolving process that requires continuous process improvement to stay one step ahead of fraud techniques and trends. Combined with machine learning algorithms such as KNN, Random Forest, Naive Bayes, Logistic Regression, and Anomaly Detection, it helps improve the accuracy and efficiency of fraud detection.

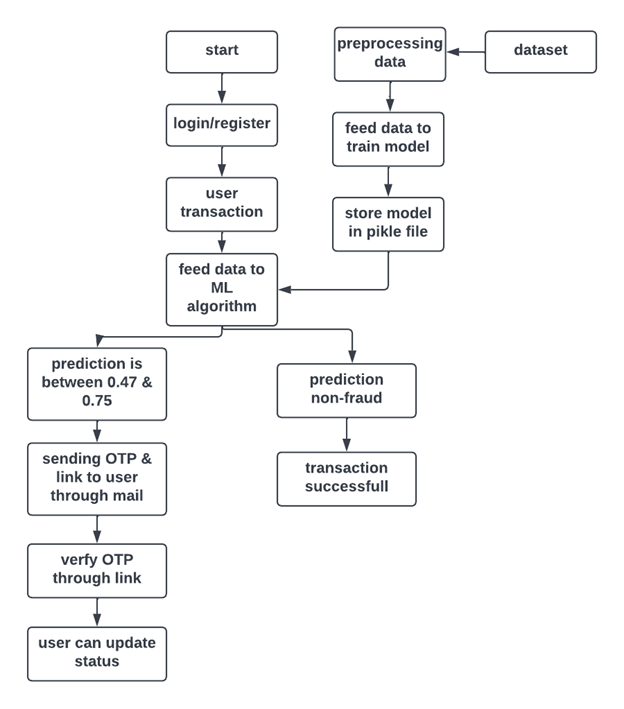

PROPOSED SYSTEM:-

- Data Collection: The system should collect transaction data from various sources such as payment gateways, merchants, and credit cards.

- Data preprocessing: Clean up inconsistent data and remove irrelevant data before data arrives.

- Feature Engineering: The system should create relevant features based on data such as currency rates, location, time and information.

- Model selection: The system should select the appropriate machine learning for fraud detection based on performance criteria such as accuracy, precision, recall, and F1 score. The preferred algorithms can be KNN, Random Forest, Naive Bayes and Logistic Regression.

- Model training: The system should train machine learning models on business history data that is considered fraudulent or legitimate.

- Model Evaluation: The system should use cross validation data and benchmark data to evaluate the effectiveness of training models.

- Real-time scoring: After the model has been trained and evaluated, the system should score the products in real time, giving each operation a false score. This fraud score can be used to determine whether a transaction is legitimate or fraudulent.

- Policy Engine: The system can also use the policy engine to define specific business rules and thresholds for certain business types.

- For example, trading over a certain amount may require additional verification.

- Anomaly Detection: The system should use anomaly detection techniques to identify anomalies in data that may indicate fraudulent data.

- Alerts and Notifications: If the transaction is considered fraudulent, the system should generate an alert or alert to the fraud analyst.

- Case Management: The system should provide an information management system where fraud analysts can manage and track incidents such as blocking cards or depositing money, and record their findings.

- Reporting and Analysis: The system should be able to report and analyze to help financial institutions monitor fraud and identify areas for improvement.

- Integration: The system should integrate with other systems and applications such as customer relationship management (CRM), fraud prevention tools, and payment gateway.

Overall, the Credit Card Fraud Management System with KNN, Random Forest, Naive Bayes, Logistic Regression, and Anomaly Detection can help financial institutions and credit card companies detect and prevent fraud more accurately and efficiently.

MODULES:-

- Data Collection Module: This module is responsible for collecting transaction data from various sources such as payment gateways, merchant processors, and card issuers.

- Data Preprocessing Module: This module pre-processes the incoming data to clean up data inconsistencies and remove irrelevant data.

- Feature Engineering Module: This module engineers relevant features from the data, such as transaction amount, location, time of day, and device information.

- Model Selection Module: This module selects the appropriate machine learning algorithm for fraud detection, based on performance metrics such as accuracy, precision, recall, and F1 score. The selected algorithms can be KNN, Random Forest, Naïve Bayes, and Logistic Regression.

- Model Training Module: This module trains the selected machine learning models on historical transaction data that has been labeled as fraudulent or legitimate.

- Model Evaluation Module: This module evaluates the performance of the trained models using cross-validation and testing on a hold-out dataset.

- Real-time Scoring Module: This module scores incoming transactions in real-time and assigns a fraud score to each transaction using the trained machine learning models.

- Rules Engine Module: This module defines specific business rules and thresholds for certain types of transactions using a rules engine. For example, a transaction over a certain amount may require additional verification.

- Anomaly Detection Module: This module incorporates anomaly detection techniques to detect outliers in the data that may indicate fraudulent activity.

- Alerts and Notifications Module: This module generates an alert or notification to a fraud analyst or user if a transaction is flagged as potentially fraudulent.

- Case Management Module: This module allows fraud analysts to manage and track cases, take actions such as blocking a card or freezing an account, and record their findings.

- Reporting and Analytics Module: This module provides reporting and analytics capabilities to help financial institutions monitor fraud trends and identify areas for improvement.

- Integration Module: This module integrates with other systems and applications such as customer relationship management (CRM) systems, fraud prevention tools, and payment gateways.

These modules can work together to create a comprehensive Credit Card Fraud Management System that incorporates KNN, Random Forest, Naïve Bayes, Logistic Regression, and anomaly detection.

APPLICATION:-

- User Dashboard: The application should have a user dashboard where users can view recent transactions, monitor account activity and report suspicious activity.

- Fraud Detection: Applications should use machine learning algorithms such as KNN, Random Forest, Naive Bayes, and Logistic Regression to identify potential fraud in real time. The fraud score generated by the model can be used to determine the probability of a fraudulent transaction.

- Policy Engine: Applications can also include policy engines that define specific business rules and thresholds for certain business types. For example, trading over a certain amount may require additional verification.

- Obfuscation detection: Applications should use a cloaking detection technique to identify anomalies in data that could indicate fraudulent data. This may include unusual exchange rates or patterns, transactions from new or unusual locations, or transactions outside of the user’s normal spending habits.

- Warnings and Alerts: If the transaction is considered fraudulent, the application should generate a warning or warning that can be further investigated for user and/or analyst deception.

- Case Management: The application should provide a data management system where fraud analysts can manage and track cases, perform tasks such as card or deposit, and record findings.

- Reporting and Analysis: The application will provide reporting and analytics that will help users monitor their account activities, identify related transactions and protect their money.

- Integration: Applications should integrate with other systems and applications such as customer relationship management (CRM), fraud prevention tools, and payment gateway.

Overall, this credit card fraud management app helps users monitor their money and protect them from fraud with machine learning algorithms like KNN, Random Forest, Naive Bayes, Logistic Regression and Anomaly Detection.

HARDWARE AND SOFTWARE REQUIREMENTS:-

HARDWARE:-

- Processor: Pentium i3 or higher

- RAM: 4 GB or higher

- Hard Disk Drive: 20 GB (free)

- Peripheral Devices: Monitor, Mouse and Keyboard

SOFTWARE:-

- Operating system: Windows 7/8/10

- IDE Tool: PyCharm/ VS code/ any Text editor

- Coding Language: Python 3.6

- APIs: Numpy, Pandas, PySpark, Matplotlib