DETECTING HIGH RISK TAXPAYERS USING DATA MINING TECHNIQUES

ABSTRACT:-

Taxpayer means as the name refers to a person or organization who wants to pay a specific amount or tax to the government on its income. Risk refers to loss of anything, but look at from the angle of government tax its a avoid of paying tax on time. Sometimes, On purpose people show their income low to avoid the government tax. Hiding information of buying ,selling of properties in the form of lands it’s also one type of risk in government tax. Because of these risks, the government suffers from a lot of difficulties during the audit period. Government faces the challenge of identifying and collecting taxes that have successfully hid- den from paying the proper tax; it’s also called as Tax fraud. Sometimes, Taxpayers misrepresent the financial facts to the government, is also tax fraud.

The main purpose of this system is to design and find out the high risk taxpayers and notify the amount of tax to the high risk taxpayers so that it would never forget to pay the government tax. In this system, various methods are used like Classification, Association, Regression, Data min- ing to detect the high risk taxpayers. This system classifies the risk ac- cording to how much tax the person wants to pay. This tax is associated

with the person based on their income. High risk taxpayers means the person who wants to pay a high amount of tax. If these taxpayers are in- creasing day by day, the government wants to suffer economic problems in our country and how the government works for our country. There- fore, this system is helpful not only to detect the high risk taxpayers but also to resolve this drawback.

Keywords: Taxpayer, Risk, Tax fraud detection, Classification, As- sociation, Regression, Data mining, High risk taxpayers.

OBJECTIVES OF THE PROJECT:-

The targets of the identification high danger citizens abuse handling procedures are :

- To utilize a data mining strategy to fortify government avoidance discovery exe- cution.

- Utilizing a preparing method a screening structure is created to channel achiev- able rebellious tank reports which might be dependent upon any examining

- To investigate anyway charge organizations may make utilization of information mining to reinforce charge consistency among the citizens

- To empower improvement in charge organization

- To try not to distort the money truth or assessment to the govt

- To have a framework that upholds the expense organization of cases and errands

EXISTING SYSTEM

In our existing framework upheld the investigation of the audited articles all through this space its prepared to arrange charge misrepresentation at an undeniable level into four significant classes specifically spending extortion bank extortion and entirely un- expected associated cash extortion it shows the quantity of articles found in such a money misrepresentation though the small things of the diagram address those numbers in rates its clear that spending misrepresentation and bank extortion address the main bit this extent compares to 41 articles out of the sixty 5 explored articles the projected order structure can function as a kind of perspective in managing cash extortion location examination through giving assistance to understudies in unmistakable territories that need further consideration this system will significantly offer exchange experts partner lists to choose the appropriate preparing method for a chose setting of money related misrepresentation for instance organizations that experience the ill effects of mastercard misrepresentation they need the partner hazard of abuse any of the directed learning in- struments for example grouping neural organization and svm and its encouraged to go

with the principal ofttimes utilized strategy choice tree as noticed this option relies upon the misrepresentation setting and handling strategy recurrence yet it’ll be else upheld execution table seven and chart one past feature the yearly conveyance of the sixty 5 articles across the 10-year amount the dark featured years 2008 2009 2010 and 2011 represent very couple of distributions in real money extortion discovery this high pace of distributions mirrors a pivotal development in real money extortion across ventures consistently in particular there had been an emotional increment of the composed papers all through 2011 this increment gave the impression to be a characteristic reaction to the flood of extortion exercises there in year a 13 increment of monetary misrepresentation in 2011 contrasted with the earlier year.

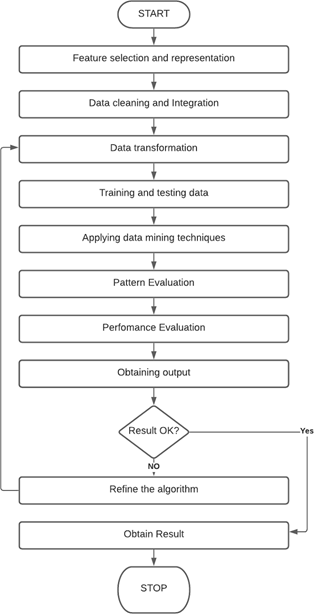

PROPOSED SYSTEM:-

The proposed characterization system can fill in as a kind of perspective in directing financial extortion recognition examination through giving the assistance to determine the troublesome regions that require huge loads of consideration this structure will sig- nificantly offer business experts a record to choose the worthy handling method for a particular setting of financial misrepresentation for example organizations that experi- ence the ill effects of mastercard misrepresentation they need a choice of utilizing any of the regulated learning instruments ie guileless bayes choice tree neural organization and svm and its encouraged to go with the preeminent continuous utilized strategy choice tree as noticed this decision depends on the misrepresentation setting and preparing procedure recurrence

MODULES:-

- User Register/Login: User have to register themself to check whether they are in high risk or not.

- Detecting Highrisk: Collecting the data and training the model based on data. Applying formulae on user input data to predict high risk taxpayer.

- Training model: Pre-processing the collected data and feeding it to the machine learning models.

ADVANTAGES:-

- This method is used to detect high risk taxpayers in a minimum amount of time.

- The power of this system is the combined use of regression techniques, support vector machines and prioritizing the high-income taxpayers.

- The main feature is the amount of taxable income based on which the purchasing, sales, revenue and profit can be calculated.

- This system Discovers fraud tax payers with potential tax responsibility and Im- proving compliance of tax deductors.

HARDWARE AND SOFTWARES:

HARDWARE:-

- Processor: Intel Core i3 or more.

- RAM: 4GB or more.

- Hard disk: 250 GB or more.

Software:

- Operating System : Windows 10, 7, 8.

- Python

- Anaconda

- Spyder, Jupyter notebook, Flask.

- MYSQL